The Ultimate Guide to Japan’s 5-Year Property Tax Rule

Timing Your Exit for Maximum Profit (2026 Edition)

Executive Summary: The Calendar Is Your Highest-Paid Advisor

Understanding the Japan 5-year property tax rule is essential for any investor. In Japanese real estate, your most important metric is not yield, occupancy, or location—it is January 1st.

Japan’s “5-year rule” for capital gains tax is one of the most misunderstood elements of the market. Unlike jurisdictions where holding periods are measured day-to-day, Japan applies a calendar-year assessment. Missing the threshold by even one calendar day can result in a capital gains tax bill that is nearly double what it would have been had the sale occurred after the new year.

Section 1: The Anatomy of the 5-Year Rule

1.1 Short-Term vs. Long-Term Capital Gains

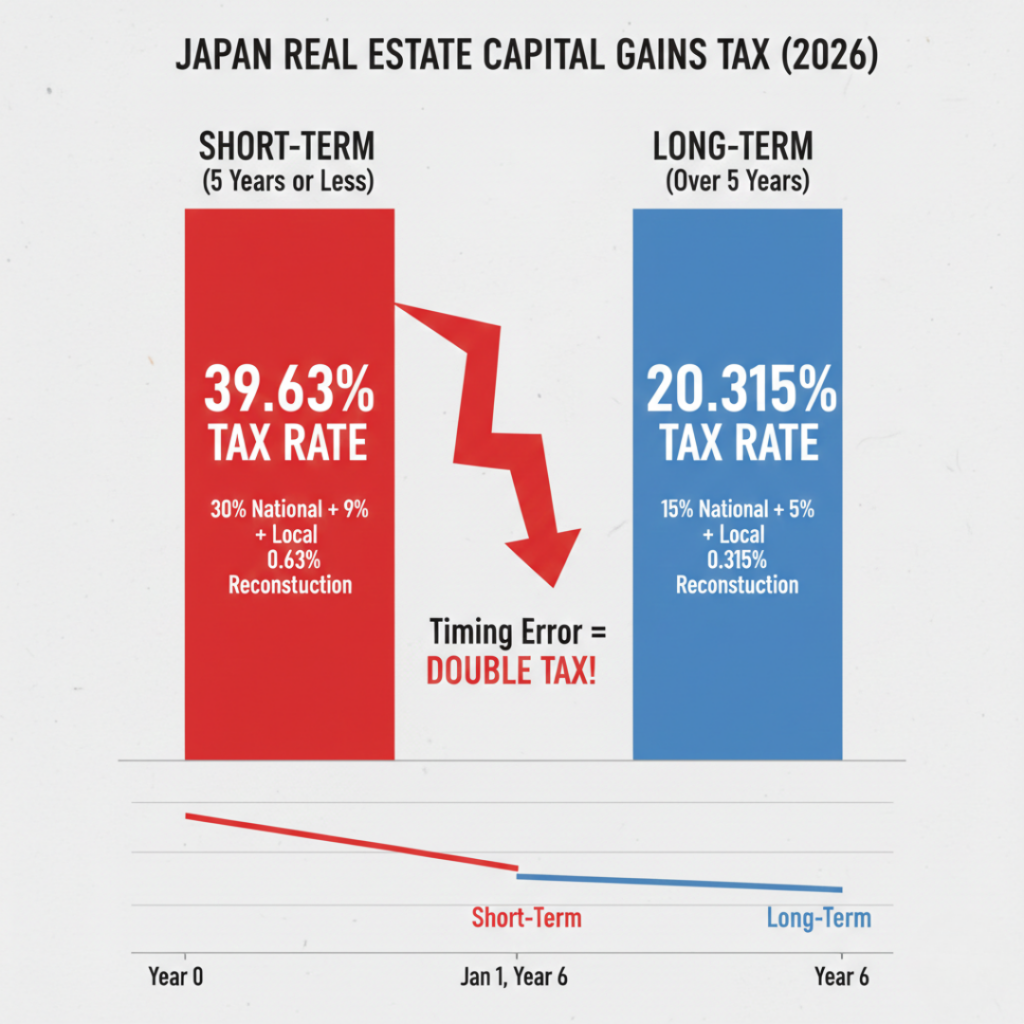

Japan’s National Tax Agency (NTA) classifies real estate capital gains into two categories based on ownership duration. The jump between these brackets is among the steepest in the Japanese tax system.

Combined national + local tax rates for individual owners (2026):

- Short-Term Capital Gains (STCG)

- Definition: Properties held 5 years or less as of January 1 of the sale year.

- Tax Rate: 39.63% (30.63% National + 9% Local Resident Tax).

- Long-Term Capital Gains (LTCG)

- Definition: Properties held for more than 5 years as of January 1 of the sale year.

- Tax Rate: 20.315% (15.315% National + 5% Local Resident Tax).

Note: The national portion includes the 2.1% Reconstruction Surtax (calculated as Income Tax x 2.1%). For example, for Long-Term: 15% + (15% x 0.021) = 15.315%.

1.2 The January 1st Rule: The Technical Trigger

The ownership period is determined by the taxpayer’s status as of January 1 of the year of sale — not the anniversary of the purchase.

The “Ghost Year” Effect

Consider a property purchased on June 1, 2020. While the investor celebrates their 5th anniversary of ownership in June 2025, the tax office looks back to the start of that year.

- On January 1, 2025: The ownership was only 4 years and 7 months.

- Impact: Any sale closed between January 1, 2025, and December 31, 2025, is taxed as Short-Term (39.63%).

- The Wait: To access the 20.315% rate, the investor must wait until January 1, 2026, for the NTA to recognize their ownership as “exceeding 5 years.”

Section 2: The Precise Math of Your Exit

Investors often mistakenly calculate gains as Sale Price − Purchase Price. In Japan, this is the quickest way to miscalculate your exit proceeds.

2.1 The Capital Gain Formula

Under Japanese tax law, selling expenses directly reduce your taxable gain rather than being added to the acquisition cost.

The Formula:

$$Capital Gain = Sale Price – Adjusted Acquisition Cost – Selling Expenses$$

Sale Price: The actual gross amount received from the buyer.

Selling Expenses: Direct costs of the sale, including brokerage commissions, stamp duty on the sales contract, and demolition costs (if applicable).

The Adjusted Acquisition Cost

The NTA requires the acquisition cost to be reduced by a depreciation-equivalent amount for the building portion. This rule applies to all properties, regardless of whether they were used as a rental or a private residence.

$$Adjusted Acquisition Cost = Land Cost + (Building Cost – Depreciation-Equivalent Amount) + Purchase Costs $$

Land Cost: The portion of the original purchase price allocated to land (which never depreciates).

Building Cost: The portion of the original purchase price allocated to the structure.

Depreciation-Equivalent Amount: Calculated based on the building’s structure (Wood vs. RC) and age at purchase.

Purchase Costs: Includes registration taxes, judicial scrivener fees, stamp duty, and brokerage commissions paid when you originally bought the property.

2.2 Structure Type and “Invisible” Profit

Because land does not depreciate, but the building does, your “taxable gain” increases every year even if the market value of the property remains flat.

- RC (Reinforced Concrete): Depreciates over 47 years.

- Wood (Mokuzou): Depreciates over 22 years.

If you own a wooden structure in a region like Niigata, your cost basis drops by roughly 4.6% per year. After 5 years, you may have “lost” 23% of your building’s book value. If you sell under the 39.63% short-term bracket, you are paying that heavy tax on a “gain” that was created by accounting, not by a market surge.

Section 3: Special Deductions & Incentives

3.1 The ¥30 Million “My Home” Deduction (3,000万円特別控除)

If the property qualifies as the taxpayer’s primary residence, up to ¥30 million of capital gain may be excluded from taxation.

- Eligibility: Must be the primary home, or sold within 3 years of moving out.

- Status: This deduction applies regardless of the 5-year rule, but residency must be proven through the Juminhyo (Resident Record).

Section 4: The Reality for Non-Resident Sellers

4.1 The 10.21% Withholding System

To prevent tax evasion by offshore owners, Japanese law mandates a 10.21% withholding tax on the gross sale price at the time of settlement.

- Is it a final tax? No. It is a security deposit.

- The Refund: The investor must file a tax return in Japan the following February. If the 10.21% withheld (from the total price) is more than the actual 20.315% tax due (on the profit), a refund is issued.

4.2 Threshold Exemptions (2026 Update)

Withholding is often waived if:

- The buyer is an individual purchasing for personal residence.

- The purchase price does not exceed ¥100 Million.

Section 5: Regional Strategy — Niigata vs. Okinawa

The “5-Year Trap” manifests differently depending on the region’s climate and maintenance realities.

5.1 Niigata: The “Yield & Hold” Model

Niigata is a cash-flow market with gross yields commonly in the 8–12% range. However, it is an “Income First” market, not a “Flip” market.

- Snow Management: Budget ¥30,000–¥50,000 per season for snow clearing. Failure to maintain this can lead to structural damage that kills your exit price.

- Exit Logic: Renovation flips (buying an Akiya, fixing it, and selling in 3 years) are rarely profitable because the 39.63% tax eats the “sweat equity” profit. The successful Niigata play is to hold for 6 calendar years, letting the high yield pay off the renovations, and exiting at the long-term rate.

5.2 Okinawa: The “Holiday Home” Transition

Okinawa is a capital appreciation market. However, in 2026, the regulatory environment for short-term rentals (Minpaku) has tightened.

- Okinawa Accommodation Tax: As of April 1, 2026, a prefectural tax of 2% (capped at ¥2,000/night) is being implemented. This must be factored into your “bridge” income if you are using rental revenue to wait out the 5-year tax clock.

- The Salt Factor (En-gai): Exterior maintenance costs are 2x higher than in Tokyo. If you wait 6 years to sell, ensure your maintenance reserve includes anti-corrosion coatings for AC units and window frames, or you will lose more in “Buyer’s Discounts” than you save in taxes.

Section 6: Net Proceeds Comparison (Illustrative Example)

Assume an investor realizes a ¥20,000,000 gain (after depreciation) in 2026.

| Item | Short-Term (39.63%) | Long-Term (20.315%) |

| Capital Gain | ¥20,000,000 | ¥20,000,000 |

| National Tax | ¥6,126,000 | ¥3,063,000 |

| Local Resident Tax | ¥1,800,000 | ¥1,000,000 |

| Total Tax Due | ¥7,926,000 | ¥4,063,000 |

| Net After-Tax Profit | ¥12,074,000 | ¥15,937,000 |

Difference attributable solely to timing: ¥3,863,000

Final Thoughts: Technical Accuracy Wins

Japan’s real estate tax system rewards patience and technical precision. The “5-Year Trap” is not an unavoidable risk — it is a timing error. Investors who prioritize technical execution over emotional convenience can materially improve after-tax outcomes. In Japan, timing itself is a financial asset.

Disclaimer: Always consult a licensed Japanese tax accountant (税理士) before executing a sale.

How I Assist With Exit Execution

Selling Japanese property from abroad is primarily an execution challenge. I provide on-the-ground support in Niigata and Okinawa for:

- Exit timing reviews and registry audits.

- Coordination of withholding procedures and non-resident tax filings.

- Local execution for overseas owners to ensure a seamless closing.

Furthermore, I actively introduce new investment properties tailored to your specific goals—leveraging my regional expertise to help you transition your capital from an exit into a high-performing new asset.

Quick FAQ

No. Unlike many other countries, the duration is not measured day-to-day from the purchase date. In Japan, the “clock” only counts full calendar years as of January 1st of the year you sell. This means you typically need to own the property for nearly six years to qualify for the lower long-term tax rate.

If you sell on December 31st, you will be taxed at the Short-Term rate of 39.63%. Waiting just one day until January 1st can flip your status to Long-Term, reducing the tax rate to 20.315%.

Running a Minpaku does not change the capital gains tax classification (short-term vs. long-term). However, it can affect your ability to claim the ¥30 million primary residence deduction, as the property must be your main home and not a rental to qualify for that specific relief.

This is a withholding tax system designed to ensure non-residents pay their dues before leaving the Japanese tax jurisdiction. It is a prepayment based on the gross sale price, not your profit. You must file a final tax return the following year (between February 16 and March 15) to report your actual gain and claim a refund for any overpayment.

By law, non-residents must appoint a Tax Agent (Nozei Kanrinin) based in Japan to handle their tax affairs and submit the necessary notifications to the tax office. You have up to five years from the deadline of the tax return to claim this refund.

Your Next Step

1. Free Discovery Call (15 Mins) Not sure if Niigata or Okinawa is right for you? Let’s have a brief chat to check your compatibility with the market.

2. The “Japan Portfolio Roadmap” Session (60 Mins / Paid) Stop guessing. We will input your specific budget and goals into our proprietary model to create a custom cash-flow simulation.

Disclaimer:

I am your Strategist, not a Tax Accountant.” “While I provide the strategic framework and simulations based on experience, specific tax filings and company registration are handled by our partner Certified Tax Accountant (Zeirishi) and Judicial Scrivener to ensure full legal compliance.