By Ayako Yamaguchi | Japan Lifestyle Strategist

When high-net-worth investors approach the Japanese real estate market, they often start with the romantic vision. They picture themselves waking up to a powder snow morning in Yuzawa, or watching the sunset over the East China Sea from a terrace in Onna-son.

Although the asset itself is important, many buyers overlook the impact of structure on cash flow. This single decision will determine your tax exposure and your peace of mind for the next decade.

We call this the decision of Structure: “Should I buy this property in my own name, or should I establish a Japanese company to hold the title?”

Rather than a simple “A or B” question, it is a multidimensional puzzle involving cash-flow timing, effective tax rates, banking access, and—perhaps most critically—long-term succession planning.

In this guide, we move beyond brochure-level advice. We break down the mechanics, expose the hidden costs, and help you identify your personal break-even point, with specific reference to the Niigata and Okinawa markets.

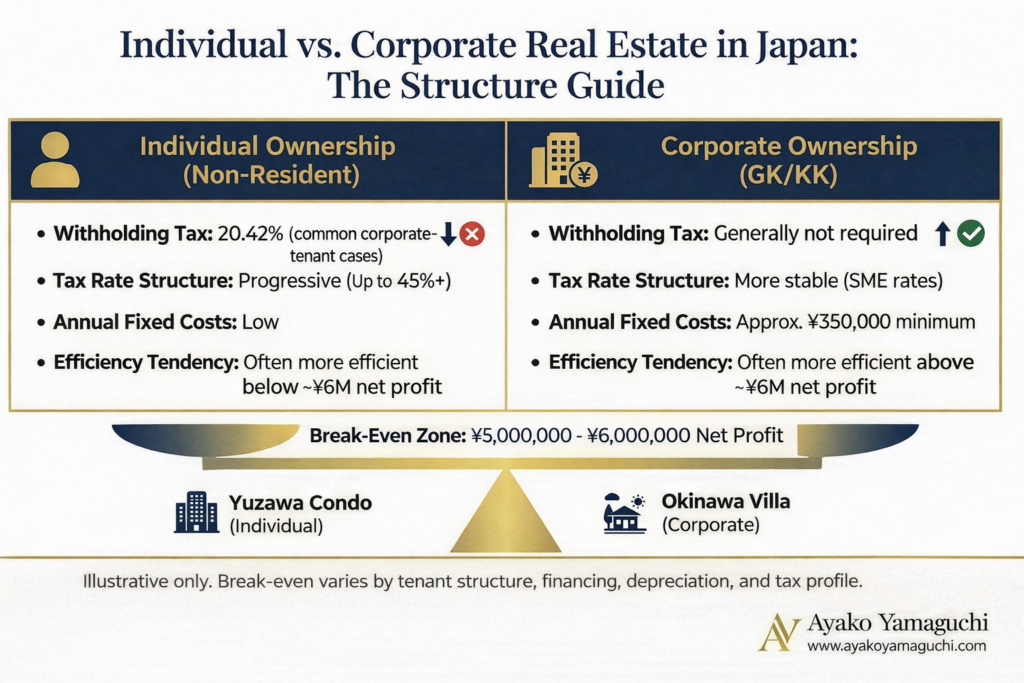

At-a-Glance Comparison: Individual vs. Corporate Ownership

| Item | Non-Resident Individual | Japanese Corporation (GK) |

| Withholding Tax | Generally 20.42% | Generally not required |

| Tax Rate Structure | Progressive (Up to 45%+) | More stable (SME rates) |

| Annual Fixed Costs | ¥50,000 – ¥150,000+ (Tax filing/Agent fees) | Approx. ¥350,000 minimum |

Part 1: The Default Trap (Individual Ownership)

Most foreign investors default to buying as an individual. It feels intuitive. You buy a house; you own the house.

However, if you are a non-resident for Japanese tax purposes, individual ownership comes with several friction points that can turn a profitable asset into a cash-flow challenge.

The 20.42% Withholding Tax Reality

When a non-resident individual leases Japanese real estate to a Japanese corporation, the tenant is generally required to withhold 20.42% of the gross rent.

This is a specific rule set by the National Tax Agency (NTA) to ensure tax collection before income leaves Japan. The tenant effectively becomes the withholding agent.

The “Cash Flow Freeze”

The Professional Compliance Gap: Tax Agent & Filing Obligations

Many people think owning property in Japan as an individual is “administratively free,” but this is not true for non-resident investors. If you live outside Japan and earn rental income from Japanese real estate, the National Tax Agency (NTA) requires you to appoint a Tax Agent (納税管理人 / Nozei Kanrinin).

Why this matters for your cash flow:

- Local contact: Your tax agent is your official point of contact with the Japanese government and handles tax-related communication for you.

- Yearly tax filing: Even if you own just one property, you still need to file an annual income tax return (確定申告 / Kakutei Shinkoku).

- It’s hard to do alone: Japanese tax rules and paperwork are difficult to manage from overseas, so most owners use a professional accountant.

- There are ongoing costs: Individual ownership is simpler than using a company, but you should still expect yearly fees for tax agent services and tax filing.

- Problems show up later: If you don’t stay compliant, penalties can apply, and selling the property later can become much more complicated.

Assume a renovated building in Niigata generating ¥1,000,000 per month in rent.

- Expected deposit: ¥1,000,000

- Actual deposit: ¥795,800

- Withheld and sent to tax office: ¥204,200

While much of this may later be refunded through a tax return, refunds are usually received after filing, often 12 months later. This is a key factor when comparing Individual vs Corporate Real Estate Japan cash flow models.

The “Individual Tenant” Exception—and Its Limits

If the tenant is an individual using the property purely for residential purposes, withholding generally does not apply.

However, in key markets:

- Niigata: Many stable tenants are ski operators or corporate dormitories.

- Okinawa: High-end villas are often leased by Tokyo-based corporations.

Avoiding corporate tenants may mean avoiding the strongest demand in these regions.

Part 2: The Corporate Shield (The “Hojin” Strategy)

When a Japanese corporation (GK or KK) owns the property, it is treated as a Japanese resident taxpayer. In many cases, rent is received without withholding.

Beyond withholding, corporate ownership offers structural advantages.

1. Business Expense Flexibility

A corporation may deduct business-related expenses if they are necessary, documented, and reasonable, including:

- Property inspections and management travel

- Accommodation during business trips

- Professional and advisory fees

- Vehicles required for operations

Note: Daily allowances and reimbursements must follow internal rules and statutory limits.

2. More Predictable Tax Rates

Individual taxation in Japan is progressive. As income rises, marginal rates increase sharply.

Corporate taxation is more stable, particularly for small and medium-sized enterprises (SMEs), making corporations attractive for higher-profit or multi-property portfolios.

Part 3: The Hidden Costs of a Corporation

Setup Costs

- GK: approx. ¥150,000

- KK: approx. ¥300,000+

- Typical setup time: 3–6 weeks

- Corporate bank account setup is often the most difficult step and usually requires professional assistance.

Ongoing Costs

- Minimum corporate inhabitant tax: approx. ¥70,000/year (payable even if you lose money)

- Accounting and tax filing: ¥250,000–¥400,000/year

- Minimum annual maintenance cost: Approx. ¥350,000

Part 4: Finding Your Break-Even Point

The ¥5,000,000–¥6,000,000 range is not a legal threshold.

It is a rule of thumb derived from common simulations, based on the following typical assumptions:

- Annual corporate fixed costs of approximately ¥350,000 (accounting fees and minimum local taxes)

- A widening effective tax rate gap as profits increase, due to progressive individual tax rates versus more stable SME corporate tax rates

- Common leasing structures where withholding tax affects cash-flow timing, but not the final tax liability

In practice, the actual break-even point varies depending on tenant structure, financing, depreciation, and the owner’s total income.

A personalized simulation should always be prepared before deciding.

Based on these assumptions, typical simulations show the break-even zone appearing when annual net profit reaches approximately:

¥5,000,000 – ¥6,000,000

- Below this range: Individual ownership often produces higher net returns due to lower administrative costs.

- Above this range: Corporate ownership tends to outperform due to improved tax efficiency and cash-flow stability.

The Beginner (Scenario A: Yuzawa Condo)

- Annual net profit: ¥2,000,000

- Verdict: Individual

Break-Even Case (Scenario B: Okinawa Villa)

- Annual net profit:¥6,000,000

- Verdict: Gray zone (lean corporate)

- Note: If the owner incurs regular and legitimate travel expenses to inspect or manage the property, corporate ownership often becomes more advantageous at this level.

Portfolio Investor (Scenario C)

- Annual net profit:¥12,000,000

- Verdict: Corporation

Part 5: Long-Term Risks Beyond Tax

Succession and Inheritance

Corporate ownership does not eliminate inheritance tax, but it can simplify succession mechanics. Instead of transferring property titles (which requires complex registration), heirs can inherit shares in the company. Estate planning advice is essential.

Liability

A corporation generally provides limited liability, helping isolate risk within the business entity. If a typhoon damages your Okinawa property and causes third-party damage, your personal assets abroad are generally protected (subject to proper management conduct).

Part 6: GK vs. KK

GK (Godo Kaisha)

- Comparable to an LLC (Limited Liability Company).

- Lower cost and simpler management.

- Preferred for most real estate investors.

KK (Kabushiki Kaisha)

- Comparable to a “Inc.” or Joint Stock Company.

- Higher cost and compliance burden.

- Suitable for large institutional operations or those seeking to hire Japanese staff.

Part 7: Exit Strategy

Selling as an individual or as a corporation leads to different tax treatments.

- Individual: After 5 years of ownership, the capital gains tax rate drops to 15% (plus local tax), which is historically very attractive.

- Corporation: Gains are taxed as regular corporate profit, but you have more options to “roll over” profits into new assets.

Exit strategy should be considered before purchase, not after.

Conclusion: Choose the Right Vehicle

- Small lifestyle property → Individual

- Long-term wealth or portfolio strategy → Corporation

The cost of planning today is far lower than the cost of fixing a structural mistake later.

Quick FAQ

It depends on net profit and long-term goals. Generally, small lifestyle assets are better as Individuals; portfolios are better as Corporations.

Generally yes for non-resident individuals renting to companies. Usually no if the owner is a Japanese corporation.

Yes, but it is expensive. You effectively have to “sell” the property to your own company, triggering acquisition taxes again.

Expect about ¥350,000 per year in fixed costs (Accounting + Minimum Taxes), even if the property sits empty.

As your Real Estate Strategist, I act as your project manager. First, I run the cash flow simulations to help you decide the strategy. Once we decide on a path, my team introduces you to the necessary specialists (Tax Accountants for tax, Judicial Scriveners for registration) to execute the legal work. We stay with you through the whole process to ensure nothing gets lost in translation.

It can simplify succession mechanics (transferring shares vs titles) and generally limits liability, but it does not strictly eliminate inheritance tax liability.

For most real estate investors, the GK is the preferred choice due to lower costs and simplicity.

Often around ¥5–6 million in annual net profit.

Yes, but dividends or salaries paid to you are taxable. Many investors choose to reinvest profits within the Japanese company.

As your Real Estate Strategist, I act as your project manager. I run the cash flow simulations to help you decide the strategy. Once we decide on a path, I introduce you to the necessary specialists (Tax Accountants for tax, Judicial Scriveners for registration) to execute the legal work. I stay with you through the whole process to ensure nothing gets lost in translation.

Your Next Step

1. Free Discovery Call (15 Mins) Not sure if Niigata or Okinawa is right for you? Let’s have a brief chat to check your compatibility with the market.

2. The “Japan Portfolio Roadmap” Session (60 Mins / Paid) Stop guessing. We will input your specific budget and goals into our proprietary model to create a custom cash-flow simulation.

Disclaimer:

I am your Strategist, not a Tax Accountant.” “While I provide the strategic framework and simulations based on experience, specific tax filings and company registration are handled by our partner Certified Tax Accountant (Zeirishi) and Judicial Scrivener to ensure full legal compliance.